Carbon & Energy newsletter (UK) - September 2023

- Post Date

- 26 September 2023

- Author

- Graeme Precious

- Read Time

- 6 minutes

- Carbon & energy management

It’s September, and along with the changing of seasons we’re delighted to provide you with the latest edition of our Carbon & Energy Newsletter. Before we dive into the latest updates on compliance schemes and legislation, we’d like to share some of the news stories to grab our attention recently.

The BBC recently released a report on the alarming reduction of sea-ice that currently surrounds Antarctica. It appears that on top of the record-breaking temperatures the UK has been receiving, records are also being achieved in Antarctic as the levels of sea-ice are significantly below previously recorded winter levels. In the past Antarctica has seemingly been very resilient to the impacts of global warming, however 2023 data is currently way off previous trends.

Obviously, the other big news recently was the UK Government policy change in relation to various ‘green’ policies, but for now we will focus on the legislation that is still in place, such as UK ETS and the proposed Carbon Border Adjustment Mechanism (CBAM) among other updates:

UK Emission Trading Scheme (UK ETS) – Consultation response

Setting the UK ETS cap to be consistent with net zero

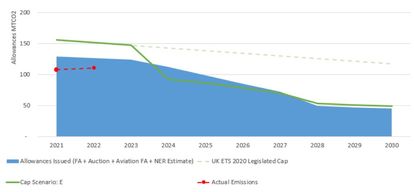

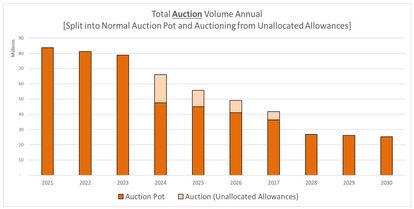

The Government have published their response to the UK ETS consultation which highlights proposed changes to the UK ETS allowance cap. The change looks to align with the UK Government’s net zero ambitions by 2050 through a new trajectory which reduces the allocation of annual free allowances. The graphs below, taken from the consultation document, highlight the key step change to be implemented in 2024 and how that compares with the previous 2020 legislation cap.

However, to produce a smoother transition to a net zero trajectory, the Government have proposed releasing a proportion of 2021-2023 unallocated allowances to auction. It is hoped that by releasing the additional 53.5 million allowances over four years, it will ensure there is no sudden drop of allowances between 2023 and 2024 and will allow the market time to adapt. More detail can be found in the consultation response document.

Expanding the scope of the scheme

As part of the consultation there was also a statement of intention to further expand the scope of UK ETS and encompass new sectors. These include introducing the domestic maritime sector by 2026 and energy from waste by 2028. The energy from waste sector has received pressure to be brought into the scheme within the decade, therefore a five-year period (with a two-year phasing period from 2026-2028) was deemed to be the most appropriate and provide enough time for the sector to prepare.

UKA Auction price review – 2021 vs 2022

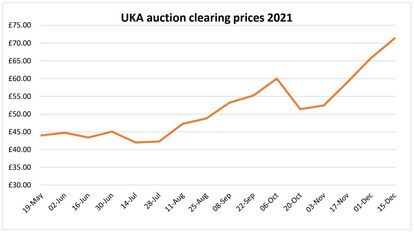

Participants in the UK ETS who exceed their free allowance threshold are required to purchase additional allowances. This is facilitated through UK ETS auctions. Analysis of the data for carbon prices highlights that from May 2021 to July 2021 auction prices ranged between £40-45 per allowance. A pattern of increases in price is then observed to its peak at the end of 2021 where the price was £71. UKA auction clearing prices then typically remained high for 2022 and peaked in August 2022 at £90 (as shown on the graphs below taken from the Government report).

Science Based Targets initiative (SBTi)

The Science Based Targets initiative (SBTi) recently released their monitoring report for 2022. This is their fourth report which reviews global progress in setting science-based targets and provides a comparison against previous years. The report highlights that in 2022 there were 87% more businesses having their targets validated (1,097) than the previous year, achieving a total of 2,079 companies with validated science-based targets. The total validated targets in 2022 alone equates to more than the previous 7 years combined!

A breakdown of validated targets by country was also provided and the UK continues to lead the way with the highest total number of targets set, however there is considerable expansion in 2022 occurring elsewhere. Asia showed strong growth overall with a 127% increase of companies setting a targets and China exhibited a 194% increase in the number of companies validated – the steepest growth curve from any other country. The US is also beginning to establish itself with a significant increase of target commitments and validations in 2022. The following image from the report provides a global illustration of companies with approved targets and commitments by region as of December 2022:

The 2022 SBTi Monitoring report can be found here.

CBAM

The Carbon Border Adjustment Mechanism (CBAM) is legislation being implemented by the EU to prevent carbon leakage from non-EU countries. Carbon leakage is where companies based in the EU move carbon-intensive production to countries outside of the EU to benefit from less stringent policies, or when EU products are replaced by more carbon-intensive imports. The EU’s CBAM will seek to put a price on the carbon emitted during the production of carbon intensive goods that are entering the EU. It is then hoped that by doing so it will encourage cleaner industrial production in non-EU countries and support with the EU’s climate objectives.

The CBAM will enter a transitional phase from the 1st of October 2023 and will apply to selected sectors deemed the most carbon intensive and at significant risk of carbon leakage: cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen. The introduction of the permanent system will involve an annual declaration for the quantity of goods imported into the EU in the preceding year and their embedded GHG. This will require the surrender of CBAM certificates and the price of which will correspond with EU ETS allowances. It is worthwhile stating that this legislation is specific to the EU and not the UK. As such, UK businesses will currently only be impacted where they are an exporter into the EU and fall within the specified sectors.

More detail on the CBAM can be found here.

GHG Protocol – Quantis tool

The GHG Protocol scope 3 evaluator tool was decommissioned on the 30th August 2023

The tool, designed to help organisations undertake an initial assessment of their Scope 3 emissions, was developed around 10 years ago, therefore the GHG Protocol has highlighted that it’s taken a decision to decommission the tool due to it being based on outdated technology. They have provided a list of resources on their website to assist with Scope 3 emission calculations. Support is also available from SLR with specialist team members who can assist with calculations. Feel free to contact us for further information.

Webinars

Corporate Citizenship (part of SLR) have a series of webinars available to help businesses explore climate risk and opportunity, along with TCFD. The webinars are only 30 minutes long and provide the option to either select any that are of most interest or watch them all as part of a series. The webinar topics, dates and times are as follows:

- Financial modelling

Date: Tuesday, 10th of October

Time: 12PM – 12.30PM BST

- Risk Integration

Date: Thursday, 2nd of November

Time: 12PM-12.30PM GMT

- Developing an adaptation plan using TCFD

Date: Wednesday, 22nd of November

Time: 12PM-12.30PM GMT

You can sign up to these and other events here.

Just Transition

We have also recently produced a report to help companies understand what a ‘Just Transition’ means for their organisation. In this report, we outline the most recent thinking on that topic and suggest how businesses can take action. The report can be accessed here.