The end of greenwashing? How companies can track their transition to transparency

by Regan Leary

View post

In January 2024, the Treasury released an exposure draft legislation[1] to introduce mandatory requirements for organisations to disclose their climate-related risks and opportunities. Our factsheet provides an overview of the disclosure requirements, and the proposed mandates cover both public and private companies, requiring the rapid implementation of climate reporting aligned with international frameworks (TCFD[2], ISSB[3]).

The requirements are comprehensive and will require a step-change in climate reporting for many Australian businesses. There are four key areas of disclosure which we think will be the most challenging for companies to address:

In this blog we will take a closer look at the transition planning requirements proposed in the ASRS exposure draft.

A climate-related transition plan, as defined by the IFRS S2 Standard is:

“an aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.”[4]

In essence, transition planning is a strategic process designed to not only guide businesses in aligning their value chain with a low-carbon, sustainable future, but also to contribute to an economy-wide transition more broadly. In October 2023, the UK’s Transition Plan Taskforce (TPT) released its first Disclosure Framework[5], setting a gold standard framework for climate transition plans, where they highlights the importance of this multifaceted approach to climate-related transition plans.

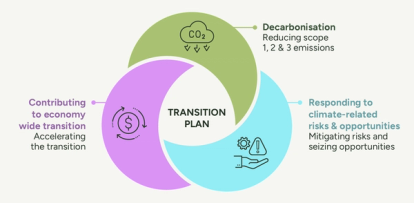

A transition plan should contain three main elements:

Transition planning is the bridge between setting ambitious climate goals and taking tangible near-term actions to achieve them. Without robust transition plans, companies struggle to align with a net-zero world. Furthermore, when developing a climate-related transition plan, it is important to align with a just transition[6] by considering the far reaching impacts that the rapid transition will have on communities around the world and work to mitigate the negative impacts of the change on vulnerable populations.

Transition plans provide a framework for companies to outline their strategies and share key details with stakeholders, including investors, governments and the public. Transition plans include:

Transition planning is not merely a regulatory necessity but a strategic imperative. Robust and credible transition plans are essential to achieving net-zero goals, fostering transparency, and enabling informed decision-making by investors and stakeholders.

The draft ASRS standard defines a transition plan as:

“An aspect of an entity’s overall strategy that lays out the entity’s targets, actions or resources for its transition towards a lower-carbon economy, including actions such as reducing its greenhouse gas emissions.”

From commencement, transition plans would need to be disclosed, including:

This indicates that from the very beginning of ASRS implementation, companies will be required to disclose their transition plans. The climate-related transition plans need to clearly articulate how an entity plans to decarbonise with clear climate related targets, resource planning to achieve the targets, as well as progress to date.

The first companies will be required to disclose from FY24/25, although smaller entities will have 2-3 years longer to prepare. Regardless of initial disclosure year, each company will follow the same sequential reporting and assurance requirements including:

The standard’s focus on transition planning is a significant step towards integrating this concept into regular corporate reporting. It places pressure on companies to develop credible and robust plans that address the risks and opportunities associated with decarbonisation.

While the draft standard sets the stage for transition planning, it also opens the door to an important discussion on the specifics of these plans. As the consultation does not adequately outline the specific expectations on entity transition plan disclosures, we suggest that alignment with the UK’s new TPT Disclosure Framework is a good place to start[5]. This gold standard framework for transition planning outlines how companies should approach their transition planning disclosures and is explicitly aligning with relevant frameworks[7] ssuch as ISSB.

The framework further guides companies’ transition planning disclosures via five critical elements:

In essence, the aim here is that transition planning becomes a foundational element of climate reporting right from the start. Further to this, limited assurance of these climate transition plans is expected in the second year of reporting, increasing to reasonable assurance by end state. This necessitates a high level of rigor from organizations when it comes to the data integrated into the plan.

Companies will be expected to capture both implemented and planned initiatives, including:

Our team at SLR brings together a wealth of local and global expertise in supporting organisations in all stages of transition planning, including:

We held a webinar covering the key aspects of the disclosures, case studies of best practice and practical guidance on where companies can begin addressing the requirements.

For those that were unable to attend, you can view the recording at the link below. This webinar is relevant for all companies who will be required to report, whether experienced in their disclosures or facing this for the first time.

Contact James, Luke or Ashleigh for further information.

[1] Mandatory climate-related financial disclosures

[5] https://transitiontaskforce.net/wp-content/uploads/2023/10/TPT_Disclosure-framework-2023.pdf

[6] https://www.slrconsulting.com/insights/enabling-a-just-transition/

by Regan Leary