Australian Sustainability Reporting Standards (ASRS) - From qualitative to quantitative, where to start on climate scenario analysis

- Post Date

- 27 September 2023

- Read Time

- 8 minutes

As of September 2024, the final standard has been confirmed with a few changes since this article was published. Please see our latest article which steps through what you need to know.

In January 2024, the Treasury released an exposure draft legislation[1] to introduce mandatory requirements for organisations to disclose their climate-related risks and opportunities. Our factsheet provides an overview of the disclosure requirements, and the proposed mandates cover both public and private companies, requiring the rapid implementation of climate reporting aligned with international frameworks (TCFD[2], ISSB[3]).

To understand who has to comply and when, download our factsheet

There are four key areas of disclosure that form the pillars of the new mandate requirements, which we think are the most challenging for companies to address:

- Scope 3;

- Climate Scenario Analysis;

- Transition Planning, and

- Assurance Readiness.

In this blog we will take a closer look at the climate-scenario analysis requirements proposed in the ASRS exposure draft.

What is climate scenario analysis?

Climate scenario analysis (CSA) is a tool by which companies can assess potential exposure to climate change risks and opportunities by examining potential futures where the extent of climate change, and the global response to climate change, varies.

As climate impact and responses are so uncertain, CSA is not intended to predict the future, but by building plausible, internally consistent scenarios it can enable companies to examine the possible impacts, and develop mitigation options where they are exposed. Companies will often explore “end-cases”, including a high warming scenario, where physical risks are high, and a rapid transition scenario where the regulatory and market impacts of the transition to a low carbon economy are particularly acute.

According to the Taskforce of Climate Related Disclosures[4], scenarios should be:

- Plausible: the events in the scenario should be possible and the narrative credible.

- Distinctive: each scenario should focus on a different combination of key factors and be clearly differentiated in structure and in message.

- Consistent: each scenario should have strong internal logic and explore the ways in which the factors interact.

- Relevant: each scenario should contribute specific insights into the future that relate to the strategic and/or financial implications of climate-related risks and opportunities.

- Challenging: scenarios should challenge conventional wisdom and simplistic assumptions about the future.

By examining multiple scenarios companies can understand the range of potential risks they could face in future.

What could companies be required to disclose on climate scenario analysis?

The exposure draft stipulates:

- “For an entity required by the Corporations Act 2001 to prepare climate-related financial disclosures, [draft] ASRS 2 requires climate resilience assessments against at least two possible future states, one of which must be consistent with the most ambitious global temperature goal set out in the Climate Change Act 2022.”

- "An entity need not disclose the detailed modelling adopted in carrying out its climate-related scenario analysis. An entity is required to disclose the inputs and assumptions used in its climate-related scenario analysis and the related outcomes.”

Qualitative Scenario Analysis

Our understanding is that the AASB require at least a qualitative scenario analysis by reporting entities in the first year. AASB expectations on the quality of content are proportionate with the experience of the reporting entity. If a company is already reporting a quantitative scenario analysis, it is expected to continue. The exposure draft mandates at least one scenario being consistent with a 1.5°C warming future and the temperature goal set out in the Climate Change Act 2022. We suggest that companies should juxtapose the 1.5°C future with a high-temperature future to assess both the transition and physical risks associated with significant temperature increase.

Quantitative Scenario Analysis

Our understanding is that quantitative climate risk assessments remain optional for all entities preparing climate-related financial disclosures. However, if during the qualitative scenario analysis, entities uncover material financial risks, they likely have a duty to their shareholders to quantify and assess the impact of the risk. This may require high quality climate models to assess physical risk exposure and potential damage to assets, or future carbon/energy pricing to assess risks in the transitional futures. Understanding of the cost, and impact, of adaptation and mitigation measures will also be key to demonstrating preparedness and resilience against material risks.

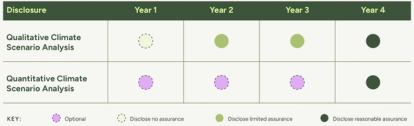

Assurance and Forward-Looking Statements

By end-state companies will be expected to have reasonable assurance of climate disclosures, including scenario analysis. The draft consultation has said companies will be required to assure their key assumptions made in the analysis including assumptions about:

- Climate-related policies in the jurisdictions in which the entity operates;

- Macroeconomic trends;

- National- or regional-level variables (e.g., local weather patterns, demographics, land use, infrastructure and availability of natural resources);

- Energy usage and mix; and

- Developments in technology.

Companies will be required to publish forward-looking statements and assessments that address how they are positioned in different climate scenarios. To help ease disclosures and transparency, Treasury has said “companies will be afforded protection from false or misleading representation claims from private litigants in relation to forward looking statements for the first three years”.

When do you have to start disclosing climate scenario analysis?

The first companies will be required to disclose from as early as FY24/25, although smaller entities will have 2-3 years longer to prepare. Regardless of initial disclosure year, each company will follow the same sequential reporting and assurance requirements. Companies are expected to report with full, reasonable assured disclosures from the fourth year onwards.

What can companies do now to prepare?

To begin addressing the impending climate-related scenario analysis requirements from Treasury, companies can follow the following process:

- Benchmark peers, industry and customers against climate scenarios chosen and identified physical and transition risks and opportunities.

- Engage with internal and external subject-matter-experts to consolidate long-list of potential risks and opportunities into shortlist that is applicable to the company.

- Determine the climate scenarios used to assess risks and opportunities, with one being consistent to a 1.5°C future.

- Prioritise risks and opportunities based on chosen climate scenarios.

- Identify future data requirements for ongoing assessment and quantification of risk and opportunities.

To effectively quantify the impacts of climate-related scenario analysis, companies will need to ensure robust data gathering that captures the resilience of assets and the business model to physical and transition-related shocks.

How can SLR support you?

Together with our decided climate risk management partners CLIMsystems, whose ‘Climate Insights’ platform allow our team to support clients to assess and quantify the financial impact from both physical and transition climate impacts, SLR is at the forefront of enhancing climate resilience. We have expertise across the range of scenario analysis requirements, including:

- Gap analysis and readiness assessments against the TCFD and Treasury requirements

- Physical risk assessments (with CLIMsystems physical hazard software platform, which supports financial impact modelling);

- Transition risk and opportunity assessments;

- Risk scoring and internal engagement;

- Translating risks and opportunities into company enterprise-risk management framework; and

- Climate scenario analysis modelling, guidance and training.

Webinar

We held a webinar covering the key aspects of the disclosures, case studies of best practice and practical guidance on where companies can begin addressing the requirements.

For those that were unable to attend, you can view the recording at the link below. This webinar is relevant for all companies who will be required to report, whether experienced in their disclosures or facing this for the first time.

Contact James or Luke for further information.