Climate Transition Plans: Decarbonisation is only one part of the puzzle

by James Balik-Meacher

View post

In our first issue of Future-Assured Insights, we discussed what it means to be “Future-Assured”—that is to say, relevant, positioned, and prepared for the evolving complexities of sustainable development. But how exactly do you go about this?

This 3-part series of Future-Assured Insights will walk you through the how—practical, prioritized actions to help your organization develop and implement a go-forward sustainability strategy.

Recall that environmental, social, and governance (ESG) refers to a collective of business relevant factors relating to an organization's relationship with the natural and human environments. These factors, traditionally under-represented or not adequately contemplated, present significant risks and opportunities for organizations and their advisors.

Before you begin to create your sustainability strategy, it is critical to understand the key driver(s) behind your organization’s push towards sustainability. The drivers of sustainability can be varied, and could include, but are not limited to, questions or concerns from external stakeholders such as investors, customers, or suppliers, committing to specific industry standards, or preparing for upcoming regulatory requirements. A thorough understanding of these drivers is fundamental to determining the level of detail required for the “next steps” that will inform your sustainability strategy.

One of the first steps in effectively developing an ESG strategy that is fit-for-purpose is to conduct a materiality assessment to identify the ESG risks and opportunities that are most critical to your organization, its stakeholders, and other rights holders. This includes engaging with those interested parties to identify priorities and garner an understanding of the organization’s operational and strategic material issues.

Materiality is a financial concept and refers to relevant information of importance that has the potential to affect an interested party’s decision making.

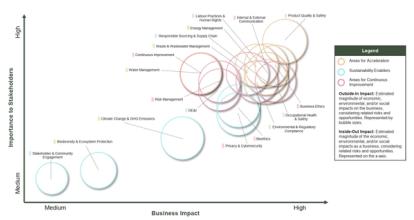

Many organizations are adopting a double materiality approach to better understand how the core operations of the organization impact stakeholders and other rights holders and wider society across the business’ entire value chain. This includes identifying the external impact on the business (outside-in) and the impact of the business externally (environmental, social, and economic: inside-out). An outcome of the materiality assessment is a matrix of material (i.e., most significant, highest priority, and most important) sustainability challenges that outline and categorize your organization’s existing focus areas.

Benchmarking involves comparing your performance to industry peers using information that is available in the public domain. This includes identifying the current ESG programs and industry best practices of peer companies, their ESG-related commitments, the ESG-related goals and targets they have set, the metrics they currently track to measure progress towards their targets, and the reporting frameworks and disclosures they currently rely on.

This is closely related to the materiality assessment, since the ESG activities of an organization’s peers and competitors should matter and be of material interest to the company’s decision makers.

Benchmarking is used to identify a desired state for your organization based on industry standards and expectations and your organization’s current strengths and potential areas of improvement relative to those of its peers and competitors. The outcome of this exercise is intended to serve as a constructive and practical starting point, anchored by real-world industry practices, to inform the development of your ESG strategy.

After defining your desired state, the next step is to assess your current state to identify the main gaps and issues that need to be addressed to help you reach your goal. This may include identifying and prioritizing gaps using selected reporting frameworks, assessing alignment of your current metrics and disclosures to those reporting frameworks, and identifying other key elements and areas of interest that you may wish to focus on. This could include emerging external issues or challenges within the legislative or regulatory arena. For example, does your organization have the processes in place to understand and meet the evolving risks and opportunities of current and anticipated climate-related policy?

The outcome of the gap analysis is a roadmap that articulates the process and steps forward in developing your ESG strategy and progressing towards your organization’s desired state.

At this point, you have established the foundation of your ESG strategy and have determined what is relevant and what matters to your organization and its stakeholders. Next, you will move on to the second stage: managing and monitoring what is relevant and what matters.

Stay tuned for Part 2 of our Future Assured Insights.

Relying on our collective knowledge and expertise, SLR has the capabilities to support you during all stages of your ESG journey. From building the foundation of your ESG strategy and identifying key ESG risks and opportunities, to developing and implementing the programs and systems required to manage and monitor those risks and opportunities, to reporting on your ESG performance, SLR is a trusted partner that can provide relevant, fact-based evaluations and develop actionable advice to support your continued ESG strategy development efforts.

by James Balik-Meacher

by Peter Lo

by Melissa Birch, Tarra Tamang