Business beyond compliance: The need for human rights action

by Heba Megahed, Miguel Oyarbide

View post

Written by James Balík-Meacher and Chloe Parkin

Since the launch of the SBTi Net-Zero Standard in October 2021, the pressure on companies to align on the definition of net zero has accelerated. This shift has been as rapid as it has been necessary, to avoid confusion about terminology and ensure the integrity of climate targets for businesses. A recent UN report on the state of company targets has only continued to highlight the need for alignment.

Companies need to demonstrate that they are aligning with global net-zero goals, to limit the worst impacts of global warming:

This must be backed up by robust, near-term reductions, long-term, deep decarbonisation, and removals of any emissions that cannot be abated before 2050.

The development and implementation of these targets must be the focus for any company wanting its climate action to be taken seriously.

Many companies wanting to be seen as a climate leader, have a desire to go beyond the baseline requirements. In addition, those in hard-to-abate sectors (that need technological innovation out towards mid-century to meet targets) are often keen to demonstrate actions now.

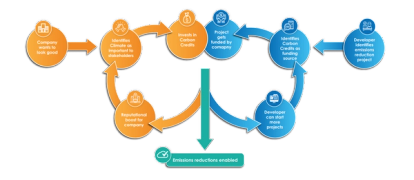

One option available to these companies, is funding projects outside their value chain that reduce or remove emissions. These projects can enable essential emissions mitigation actions that would otherwise lack funding sources. Many companies will then match up these emissions reductions against their own direct emissions, or “offset” them.

The recently released AR6 Synthesis Report from the UN’s Intergovernmental Panel on Climate Change (IPCC), made it clear that we need to be utilising as many available mitigation options as we can. While offsetting cannot be a substitute for gross emissions reductions by companies, it can be a vital source of funding for otherwise non-viable projects.

“Deep, rapid and sustained mitigation actions would reduce future adaptation costs and losses and damages, enhance sustainable development co-benefits, avoid locking in emission sources, and reduce stranded assets and irreversible climate changes.” IPCC AR6 Synthesis Report

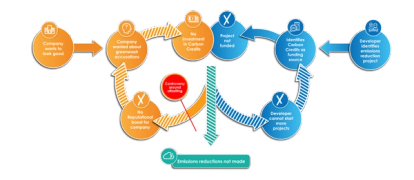

However, offsetting and the voluntary carbon market have, for much of the last 20 years, and especially in recent months, been subject to controversy, scrutiny and negative press. Claims persist that projects are overestimating emissions reductions, that the verification systems in place are inadequate, or that companies are using these offsets to avoid making emissions reductions in their own operations and value chain. This has meant that rather than being a potential boon, investing in these projects is becoming a massive potential liability for companies.

Scepticism could cause companies to pull back from these initiatives, and lead to funding gaps for potential mitigation projects.

Ultimately, carbon credits should provide two important functions:

If the second is no longer true, the first falls down.

Buying carbon credits from a registry, or claiming carbon neutrality through offsets that the company had no input to or connection with, only exacerbates the risk of greenwashing claims, and exposes companies to uncontrolled risks if these schemes turn out to be less than perfect.

Companies looking for opportunities to accelerate their climate strategy, need to be thinking more holistically about the projects they are funding, not just attempting to “cancel out” emissions in the cheapest way possible. Rather than buying “off-the-shelf” carbon credits, companies need to take a step back, and think about why they are doing this. For most companies, the ultimate drivers are reputation and stakeholder engagement: the story they can tell, how they are supporting climate solutions, and the positive impact the projects are having.

In order to maximise these drivers, companies need to assess the alignment of projects with their products, services, business strategy and other sustainability programmes, such as social impact. This will require more effort from companies, to identify, understand and engage with the projects they are funding, but will in turn provide them with the reassurance necessary that the projects are delivering, and that there is a coherent story to tell around the impacts they are having. In our accompanying article this month, carbon markets & climate finance expert Olivier Levallois, Founding Director at Hamerkop, details some of the steps companies can take to ensure their approach to offsetting is as robust as possible.

by Heba Megahed, Miguel Oyarbide