Sustainable mining practices: Securing closure capital from exploration to reclamation

- Post Date

- 21 May 2025

- Read Time

- 5 minutes

This is Part 1 of a three-part series on making mining (or any industry with environmental liabilities) more sustainable by leveraging financial mechanisms. These articles will explore how the influence of money and law can be harnessed to promote ethical practices while simultaneously saving money.

With a growing number of mines reaching closure and seeing closure costs materialize, regulators, lenders, and banks are observing projects that fail economically by miscalculating the cost to close their site(s). In Canada, mining projects are subject to both provincial/federal environmental and mining legislation. Generally, provincial or territorial legislation sets the requirements for the tailings storage facility and the storage of waste rock and other waste products. Additionally, federal legislation typically sets the requirements for effluent discharge, navigable waters, fish-bearing water and fisheries, and matters on federal lands.

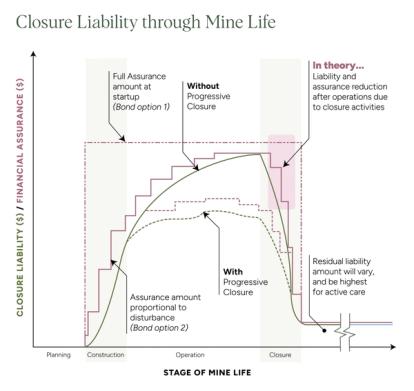

Since the 1990s, a mine closure plan is required by law in Canada, and mining companies, owners or license holders must also provide financial assurance (i.e., closure security or bond), to ensure that appropriate funding is available for executing the plan prior to starting work. The closure security is in place in the case of abandonment where the government would have to take on the liability. Certain jurisdictions require the closure plan to be filed prior to any exploration activities being undertaken and the plan may be subject to contaminated site remediation obligations.

As the closure plan is considered a living document that is reviewed and updated periodically to reflect mine and legislation changes, the closure guidelines are well documented:

- The Mining Association of Canada provided a guideline toward sustainable mine closure framework that supports comprehensive engagement with communities of interest throughout the mining life cycle to build long-term support and commitment to the local stakeholders (MAC, 2008);

- The National Orphaned/Abandoned Mine Initiative outlined the policy framework in Canada for mine closure and management of long-term liabilities. The document outlines the typical risks in closure, assessment to evaluation the risks, financial assurance framework, cost estimate, long-term monitoring and maintenance, premature closure, relinquishment, and institutional custodianship (NOAMI, 2017); and

- Regional jurisdictions have detailed guidelines on how to form and file closure and reclamation cost estimate for mines (INAC, 2017) along with best practice guidelines from international committee (ICMM, 2019).

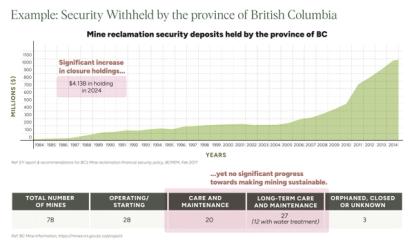

Despite all the measures, the number of mines that have been fully closed in Canada is relatively small. Most of the inactive, unclosed mines are operating under “care and maintenance” conditions or classified as orphaned or abandoned.

Abandoned Mine: no active mining claims or leases and where the owner responsible for the mine no longer exists or cannot be found.

The goal of the closure security is to ensure the responsible government agency can use it to close the site in the event of abandonment. The cost of government-run mine closure activities after abandonment is often more than the amount available. This overrun could be due to several factors, including but not limited to:

- Lack of robust scientific methods and execution details in the historic closure plan leading to an underestimation of security;

- Wording in the mine license that states a closure plan only needs to be submitted one year before reaching closure;

- Amount of security reduced over time from spending during care and maintenance of the site or emergency repairs under government administration, which comes from the same source of funding as the closure execution fund;

- Significant deterioration of the structures and equipment over time that are not considered in the security;

- Changes in legislation, standard practice, or stakeholder requirements from the time of security establishment which may require new environmental and engineering studies that were not considered in the original estimate; and

- Misapplication of net present value (NPV) analysis with mine activities occurring into perpetuity (e.g., water treatment, seepage interception).

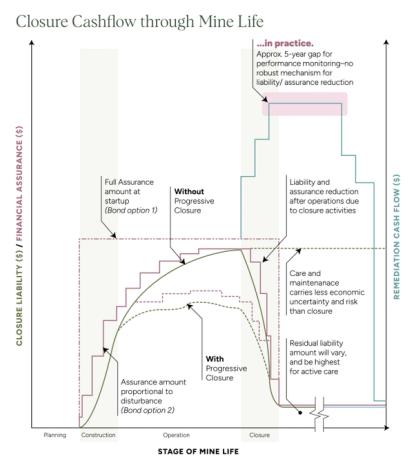

Realistically, the most effective way to close mines would be to have the owners close their own sites. Mining companies should be encouraged to advance their inactive properties from care and maintenance to active closure. A major issue for mining companies is the lack of reliable ways to release the security, which can lead to additional closure costs. British Columbia, one of the largest mining jurisdictions in Canada, held CAD $4.13 billion in security for active and inactive mines in 2025.

This pool of credit should motivate mining companies to close their properties to reclaim their funds.

However, the process to release this security is complicated. Often, the full amount is held until all post-closure conditions are met, which can take a very long time. The length of the observation period required to ensure closure stability practically ensures the securities will be held indefinitely.

Without clear criteria and release mechanisms, companies are reluctant to invest more money in closing their mines.

In Part 2 of this series, we will explore strategies for releasing the funds needed for closure.

Recent posts

-

-

Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post -