Building Near Rail Lines in Canada: How to Manage Noise, Vibration, and Approvals

by Ben Adler

View post

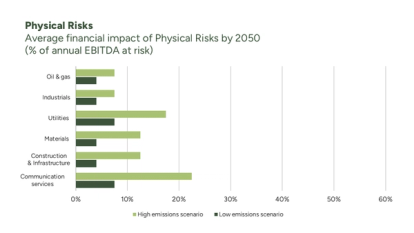

Climate-related risk is increasingly being recognised as one of the most material and pressing financial issues facing organisations. Disruptions to operations, asset devaluation, and long-term business viability are threatening financial performance – particularly for asset-heavy sectors such as telecommunications, utilities, energy, and travel.

Recent reports published by the World Economic Forum (WEF), underscore the high cost of inaction and the importance of building business resilience.

You can view more about this via the WEF’s The Cost of Inaction: 2024 Annual Report and the WEF’s Business on the Edge 2024 Insight Report.

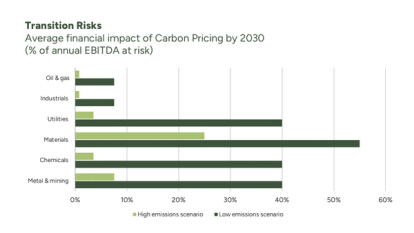

Whilst the financial impact of physical risks, like extreme weather and flooding, can be easier to identify and quantify, transition risks may have a far greater influence in the near-term. Using carbon pricing as a proxy for this risk, companies could experience EBITDA erosion of up to 50% by 2030 under a low emissions scenario, and up to 25% under a high emissions one.

Whilst the impacts of transition risks are clear, quantifying their financial effects is complex. These risks are influenced by evolving policy, regulation, technology and market conditions, meaning outcomes vary widely by region, sector and business.

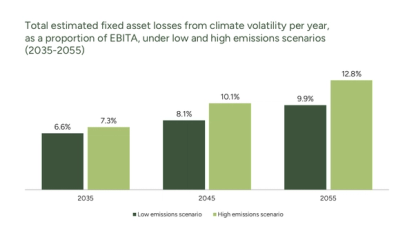

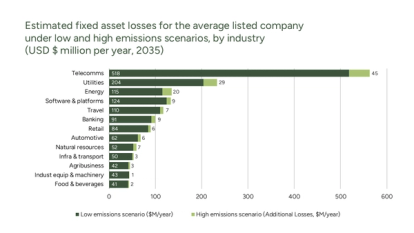

Climate-related risk affects all sectors, but those that are more reliant on fixed assets or exposed to complex supply chains are particularly vulnerable. For instance, companies in the telecommunications, utilities, and travel sectors could see EBITA decline by as much as 20% over the next decade due to damage to fixed assets from climate-related hazards. Among these, telecommunications is one of the sectors most at risk with the average listed company facing annual losses of nearly $600M due to damage to cell towers and other infrastructure from extreme weather events.

There is a strong business case for investing in adaptation and resilience. Companies that act early benefit from:

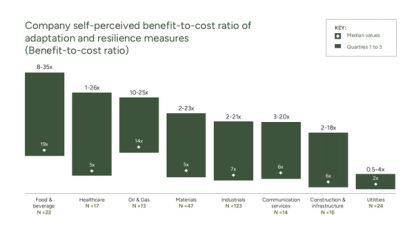

Across sectors, surveyed companies expected the benefits of resilience actions to be at least double the associated costs.

In the past, a qualitative understanding of climate-related risks was often sufficient. Today, however, investors and regulators are increasingly demanding robust quantitative assessments paired with actionable and financially balanced mitigation strategies.

Whilst sector level trends and climate data may help identify and rate climate-risks, financial impact assessments are more complex. Asset type, location, exposure, sensitivity, and adaptive capacity (amongst other factors) all influence how climate risk translates to the bottom line. As a result, assessments must be tailored to your business and assets.

Our team has extensive experience, access to best-in-class climate data and analytics and deep technical know-how to help our clients quantify their climate-related risks and build resilience.

We will be hosting two short webinars covering financial quantification of potential climate impacts: this first session (Thursday 31 July) will focus on climate transition risks and opportunities, whilst the second (Thursday 7th August) will be tailored to physical risks.

Click here to register for webinar 1.

Click here to register for webinar 2.

To learn more, contact our team today.