Part one: Comminution, flotation and sample preparation at SLR’s mineral processing laboratory

by Ben Simpson

View post

The mining industry is undergoing a profound transformation as environmental, social, and governance (ESG) considerations—once viewed as optional—have become central to operational success and long-term viability. Investors, regulators, and communities increasingly demand transparency and credible performance across the entire mine life cycle, from exploration to closure.

Recall that “ESG” refers to a collective set of business-relevant factors that define an organization’s relationship with both the natural and human environments. These factors—historically underrepresented or insufficiently addressed—carry significant implications for risk management and value creation. When properly understood and integrated, ESG considerations reveal the full dynamics of an organization’s operating environment. This deeper understanding may uncover areas of potential liability, but that insight is itself a benefit; it enables informed decision-making and strategic positioning to mitigate risk and capture opportunity.

In Canada, this expectation is reinforced by evolving domestic regulations and global sustainability trends. The modernization of NI 43-101 by the Canadian Securities Administrators (CSA) aims to streamline disclosure requirements, clarify definitions, and align with global best practices, making ESG factors more explicit in technical reporting. At the same time, initiatives such as the Consolidated Mining Standard Initiative (CSMI) seek to harmonize ESG standards across jurisdictions, reducing fragmentation but raising compliance expectations.

The regulatory landscape around greenwashing has also shifted. The Canadian Competition Bureau introduced strict guidelines in 2024 requiring companies to substantiate environmental and sustainability claims with clear, verifiable evidence. For mining companies, this means ESG disclosures and sustainability statements must be credible and defensible, avoiding vague or exaggerated language that could mislead stakeholders.

Historically, the cost of environmental impacts was assumed to be negligible compared to the value of the resource. However, activities that persist into perpetuity—such as seepage interception and water treatment—are proving that assumption false. These long-term obligations highlight the need to account for full lifecycle costs and risks, reinforcing why ESG is not just a compliance exercise but a strategic imperative. Mining companies must adopt practical, scalable, and credible ESG strategies that deliver measurable value across the mine life cycle—strategies that position projects for resilience and long-term success while meeting evolving regulatory and stakeholder and rights holder expectations. But how can companies achieve this in a way that is both cost-effective and aligned with industry standards?

SLR’s ESG Guidance & Evaluation Tool was created to address a gap in the industry. While established sustainability frameworks such as the Mining Association of Canada’s Towards Sustainable Mining (TSM), the International Council on Mining and Metals (ICMM) Principles, and The Copper Mark provide robust guidance for operating mines, they often overlook the unique needs of early-stage projects. Junior exploration companies and mid-tier developers, in particular, frequently operate with limited ESG resources and require practical, affordable solutions that can be implemented without disrupting project timelines.

The Tool was designed to meet this need by offering a structured, stage-specific approach to ESG appraisal. It evaluates performance and exposure across a comprehensive set of ESG themes tailored to each stage in the mine life cycle—from exploration through closure. Inspired by leading industry standards and protocols, the Tool is largely compatible with accepted sustainability frameworks, ensuring credibility and alignment with stakeholder and rights holder expectations.

What sets this Tool apart is its modular design and liability-focused approach. Assessments can be customized to reflect the current stage of a project or asset, allowing mining companies to identify material ESG risks early, evaluate existing practices, and prioritize actions that minimize liability while supporting long-term value creation. Unlike previous checkbox-style ESG appraisal approaches, the Tool incorporates that baseline while providing a structure informed by SLR’s experience with practical risk drivers. This means complex issues are simplified through a practical lens, with an emphasis on early intervention. Its flexibility makes it suitable for companies of all sizes—from junior explorers to large-scale operators—providing a scalable solution that balances rigor with accessibility.

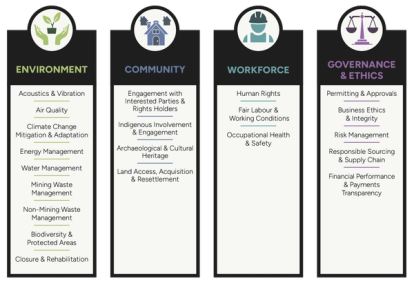

The ESG Evaluation & Guidance Tool provides a structured, comprehensive assessment of ESG performance across four core categories: environment, community, workforce, and governance and ethics. Each category includes a detailed set of indicators designed to capture the most relevant aspects of ESG performance for mining projects. Together, these indicators offer a holistic view of how a project or asset measures up against best practices and regulatory expectations.

The Tool evaluates both the current state—where the project or asset stands today—and the desired state, which reflects the level of ESG performance needed to meet stakeholder and rights holder expectations and minimize risk. In this way, the Tool functions as a roadmap for improved ESG outcomes. It can be applied at the project or asset level while considering corporate-level policies and commitments, and it is equally effective for portfolio-wide assessments.

To deliver these insights, the Tool integrates multiple methods: desktop reviews of documentation, interviews with internal stakeholders and subject matter experts, and gap analyses against a “standard of care” developed by SLR’s technical specialists. This standard of care represents the minimum expected requirements for each indicator at each stage of the mine life cycle, based on regulatory obligations, industry best practices, and hands-on experience.

The Tool can be used in two ways. Mining companies may opt for self-evaluation, which provides internal insight for planning, decision-making, and continuous improvement. Alternatively, they can choose third-party evaluation, where SLR independently validates ESG performance using information provided by the company. This approach requires minimal effort from the client and offers external credibility for investors and regulators.

Regardless of the assessment method, the evaluation produces a suite of actionable outputs. These include a gap analysis highlighting deficiencies against the standard of care, summarizing any environmental liability that was not previously identified, benchmarking against international frameworks, and transition planning to prepare projects for alignment with more rigorous ESG standards as they advance. Strategic insights derived from these evaluations inform ESG strategy development, risk management, and stakeholder and rights holder engagement. By focusing on early identification and mitigation of ESG risks, the Tool supports better decision-making, reduces long-term liabilities, and enhances overall project value.

The ESG Evaluation & Guidance Tool has already proven its value through multiple real-world applications, helping mining companies make informed decisions that reduce risk and enhance long-term project viability.

In one engagement, a junior gold exploration company faced critical decisions about tailings management under significant budget constraints. Tailings management is one of the most material ESG issues for mining projects, carrying substantial environmental and financial liabilities if not addressed early. Using the Tool, SLR conducted a focused literature review of tailings management options, performed a gap analysis against the standard of care, and engaged with industry experts, including consultants and operators, through targeted interviews. This process provided a clear understanding of the environmental liabilities associated with various management strategies. The outcome was a tiered strategy for liability reduction, complete with actionable insights into regulatory expectations and best practice recommendations. Equipped with this information, the client was able to select a strategy that minimized environmental risk, reduced potential future liabilities, and aligned with stakeholder and rights holder expectations, all within the constraints of a modest budget.

In another case, a junior gold exploration company preparing for future growth sought to define its ESG strategy before advancing to development. SLR applied the Tool to conduct a corporate-level ESG gap analysis, complemented by a light materiality assessment and a thorough review of existing documentation. Interviews with key internal stakeholders and subject matter experts provided additional context, ensuring that recommendations were grounded in operational realities. The result was a clear, actionable roadmap for ESG integration, aligned with the company’s material issues and strategic objectives. This roadmap positioned the organization for sustainable growth, improved investor confidence, and readiness for more rigorous ESG requirements as its projects matured.

In a final example, a lender requested SLR prepare a due diligence review of a future mining project. Rather than follow the common practice of summarizing historic reports, SLR critically reviewed all discipline-specific baseline and assessment reports using the environmental liability component of the Tool. This review—combined with SLR’s experience in identifying commonly overlooked mine waste risks and costs—enabled the formulation of a conceptual model of environmental liability for the project. Only with that model could we pinpoint gaps that often fall between disciplines rather than within any single one. Using this approach, we identified a likely pathway for tailings-impacted water to reach a protected fish species—an issue that had not been previously considered. With a clear understanding of that liability, the lender can feel more confident in financial predictions and the operator can take steps to lower the liability.

These examples highlight the Tool’s versatility and practical impact. Whether addressing highly technical issues like tailings management or shaping corporate-level ESG strategies, the Tool adapts to the unique context of each engagement. Its ability to deliver actionable insights within constrained budgets demonstrates that meaningful ESG integration is achievable even for early-stage projects. By bridging gaps between disciplines and aligning recommendations with regulatory expectations and stakeholder and rights holder priorities, the Tool transforms ESG from a compliance exercise into a strategic advantage—helping mining companies make informed decisions today that safeguard value for the future.

The ESG Evaluation & Guidance Tool delivers tangible benefits for mining companies at every stage of development. Enabling early identification of ESG risks, it helps reduce long-term liabilities and supports informed decision-making that can prevent costly delays and reputational damage. Its structured approach provides clarity and confidence, enhancing stakeholder and rights holder trust through credible, verifiable performance data that aligns with investor expectations and regulatory requirements.

Affordability is a key advantage. Entry-level assessments make ESG integration accessible to companies with limited resources. At the same time, the Tool’s scalability ensures relevance for site-specific projects, portfolio-level reviews, and corporate-wide strategies. By simplifying complex ESG challenges through a liability lens and leveraging an integrated team of experts who understand that risk often lies between disciplines, the Tool empowers mining companies to strengthen governance, improve operational outcomes, and position themselves for long-term success—regardless of where they are in the mine life cycle.

SLR is actively applying the ESG Evaluation & Guidance Tool to projects worldwide and is exploring opportunities to evolve the platform into a digital dashboard or software-as-a-service solution. Future enhancements will include greater integration across SLR practices and regions and broader adoption in international markets. As ESG expectations continue to rise, practical and scalable solutions like this Tool will be essential for mining companies seeking to navigate complexity, minimize risk, and unlock long-term value.

Drawing on our collective knowledge and expertise, SLR has the capabilities to support mining companies throughout their ESG journey. From building the foundation of an ESG strategy and identifying key risks and opportunities, to developing and implementing programs and systems for monitoring and reporting, SLR provides fact-based evaluations and actionable advice. Our goal is to help clients not only meet compliance requirements but also create strategies that deliver measurable value and resilience in an increasingly demanding global landscape.

by Ben Simpson

by Chynna Pickens, Claire Carter

by Vincenzo Giordano, Bob Robinson, Clément Barbaux