How California’s climate disclosure requirements can deliver value for your business

- Post Date

- 01 October 2025

- Read Time

- 7 minutes

October 2025 update: The California Air Resources Board (CARB) has announced a delay to its rulemaking on California's new climate disclosure laws, creating further uncertainty for companies required to meet the statutory January 1st deadline for publishing climate risk reports. At SLR, we work with companies across various sectors to take a pragmatic approach to climate risk assessment and scenario analysis, enabling them to prepare for compliance and deliver business value. Get in touch to find out more.

To recap: California Senate Bills 253 and 261 take effect with initial reporting deadlines in early 2026, requiring large organizations to disclose their greenhouse gas emissions and climate-related financial risks. A recently released list identifies over 4,000 companies [1] subject to the regulations, although it is not exhaustive. Even if your company is missing from the list, you may still be subject to the requirements.

But meeting the requirements can be more than just a compliance exercise. They present an opportunity for forward-thinking businesses to enhance resilience, strengthen stakeholder trust, and position themselves as climate leaders. Preparation is key: companies that act now will stay ahead, while those who wait risk scrambling to meet tight deadlines.

Both laws require sophisticated data collection, risk assessment, and transparency across operations and supply chains. Most organizations will need to build or upgrade existing systems and coordinate across sustainability, finance, risk, and leadership teams.

The TCFD advantage

SB 261 references the Task Force on Climate-related Financial Disclosures (TCFD) Recommendations, which set out a framework for companies to report their management of the risks posed by climate change. This alignment with TCFD gives many U.S. companies a head start, since several of the TCFD’s recommended disclosures are already reported by over 50% of large companies in North America, according to a 2024 review [2]. One of the most commonly disclosed metrics is GHG emissions, which is the focus of requirements under California SB 253.

By building on existing reporting and aligning with TCFD early, companies can streamline compliance efforts by treating emissions reporting (under SB 253) and climate risk assessment (under SB 261) as complementary rather than separate initiatives. Below, we outline an approach to establishing a future-proofed reporting system and risk management framework, based on our experience in helping companies meet regulatory requirements while delivering value to their business.

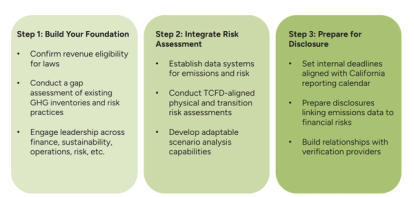

A strategic preparation framework

Step 1: Build your foundation

First, confirm whether your company meets the eligibility requirements for either of these laws. Then conduct a gap assessment to establish a baseline and prioritize where systems, processes, or data collection need strengthening. Get your leadership teams involved early, including finance, sustainability, operations, and risk management. Doing so ensures climate data is connected to business strategy, resources are allocated effectively, and disclosures will carry more weight with regulators and investors.

Step 2: Integrate risk assessment

Based on the identified gaps, implement data systems that support both emissions tracking and climate risk evaluation. Scope 3 reporting requires a robust data infrastructure to effectively engage suppliers and integrate value chain impacts. At the same time, conduct TCFD-aligned risk assessments that capture both physical risks (like flooding or extreme weather) and transition risks (like policy changes or market shifts), and build scenario analysis capabilities that can adapt as regulations evolve while providing useful insights for business planning – see below for more on SLR’s pragmatic approach to doing so.

Step 3: Prepare for disclosure

Set internal deadlines that align with California's reporting calendar and allow time for third-party verification. Start building relationships with verification providers now, as requirements may become stricter over time. Prepare disclosures that connect your emissions data with a narrative on financial risk, demonstrating your understanding of how climate change may impact your business.

CARB updates: Draft checklist and key guidance

In September 2025, CARB released a draft checklist [3] clarifying the minimum climate-related financial risk disclosure requirements for SB 261, structured around the four TCFD pillars:

- Governance: Disclose the organization’s governance framework related to climate risks and opportunities, including board oversight and management’s roles and responsibilities in climate risk management.

- Strategy: Report on the actual and potential impacts of climate-related risks and opportunities on business operations, strategy, and financial planning over short, medium, and long-term horizons.

- Risk Management: Describe processes used to identify, assess, and manage climate-related risks, including integration into overall risk management systems.

- Metrics and Targets: Disclose key metrics and targets used to assess and manage relevant climate risks and opportunities. While full emissions reporting (Scopes 1, 2, and 3) is encouraged and aligns with TCFD, CARB clarified that emissions disclosures are not mandatory for the initial SB 261 report in early 2026.

CARB encourages companies to provide qualitative scenario analyses "where feasible and relevant," recognizing quantitative scenario disclosures as a longer-term expectation. Reports must include a statement on the reporting framework used (e.g., TCFD or IFRS S2) and explain any disclosures not included, with plans to address gaps in future reports.

This checklist provides companies with a clear, focused framework for meeting SB 261’s minimum reporting expectations while allowing flexibility for evolving disclosure depth. Early initiation of TCFD-aligned reporting under these four pillars will help companies demonstrate effective climate governance and risk oversight ahead of regulatory deadlines.

How SLR can help

At SLR, we specialize in helping companies navigate climate disclosure requirements across jurisdictions. From developing accurate GHG inventories and conducting TCFD-aligned risk assessments to supporting third-party assurance and disclosure strategy, we provide end-to-end expertise.

While California’s regulations may be new, we build on deep technical expertise in carbon accounting and climate risk assessment, combined with practical knowledge of business operations and stakeholder expectations. Our phased approach initiates readiness activities now, refines them with CARB’s upcoming October draft rules, and finalizes compliance after the December rules. This way, companies avoid last-minute rushes and use the disclosure process as a strategic advantage.

The regulatory landscape is changing fast, but companies with strong foundations and strategic thinking will emerge as leaders. Rather than exhaustively analyzing every scenario, we take a pragmatic, materiality-first focus, targeting the most relevant impacts by business model and geography to maximize efficiency and value.

Ready to get started? Contact our Corporate Sustainability team to discuss your strategic approach to California's landmark legislation. Learn more about our climate and sustainability services and how we can help transform compliance into a competitive advantage.

Contact usStay informed as CARB updates continue to emerge, with draft rules expected in October and final rules by December. The question isn't how you'll comply with California's requirements but how strategically you'll approach them.

References

[1] https://content.govdelivery.com/accounts/CARB/bulletins/3f42d2c

Recent posts

-

-

Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post -